Who is Adyen?

Hello, we are Adyen! We provide payment services, and your platform has partnered with us to provide several of these services. We're most likely processing your platform's incoming transactions and then distributing those funds to wherever they are supposed to go (for example, to your bank account).

To do that, though, we need to comply with some international banking regulations. Those regulations require that we verify some of your information with official records, including conducting identity and bank checks. Once all of that is done, you are free to accept transactions and receive payouts through your platform.

How does this work?

You still keep the same relationship with your platform, and they are still your go-to contact for any support.

We, as Adyen, provide payment services for your platform, including processing transactions and distributing those funds where they are supposed to go (for example, payouts to you). To comply with international regulations for payment service providers, we have to verify your business, identity, and bank information with official records.

If your information isn't received or cannot be verified in time, then we're required to stop all payments processing and payouts. In that case, contact your platform.

What does the time limit mean?

Because we are collecting your sensitive business and personal information, we've implemented additional security features to ensure everything stays safe. For example, the hosted onboarding link is only valid for 4 minutes.

If the link expires, you must get a new link from your platform. The link also expires if you refresh the page and your session will end.

When you start a new session, some of your information from the previous session may have been saved. Your information is saved when you complete and submit an entire section. It also is saved if you have provided the required information for a step and selected the Save and go to overview button.

What happens to my data?

We have a privacy policy that covers how we process and store any information that you share with us. We're very serious about data protection, and we will never share your information with advertisers.

Our Underwriting team can see your information and documents when they conduct the verification checks, and they also need to share it with the third parties who help us match information with official records. Finally, as per our partnership agreement, your platform can view your information, but they cannot access any of the documents you upload.

What type of ID do I need to provide?

To verify your identity, we need to see an official photo identification document that was issued by the government. The document must be a physical photo ID document, not digital. Make sure that the document is still valid—we cannot process expired, hole punched, or otherwise modified documents.

Make sure that the document is a photo or scan of the physical ID document—we also cannot process a screenshot of a photo, a photo pasted on another document, a photo of a screen, or a photo of a printout.

We're happy to receive a scan or photo of one of these ID types.

- Passport: make sure to scan the data page, including your photo, MRZ code, and all data.

- Driver's license: upload one scan of the front side and one of the back side.

- ID card: scan the front side and the back side of a government-issued ID card.

For a speedy verification process, check out our tips for uploading your ID document:

How can I verify my bank account?

To confirm that you own the bank account where you'll receive payouts, we need to see an official bank document.

Supported bank document types:

- Bank statements

- Deposit tickets or deposit forms

- Screenshots of your online banking environment

- Official emails or letters from your bank

- Cheques

Country specific documents:

- Relevé d'Identité Bancaire (RIB): bank document in France

- TAMIEYTHPIO: bank document in Greece

- Singaporian bank passbooks: bank document in Singapore

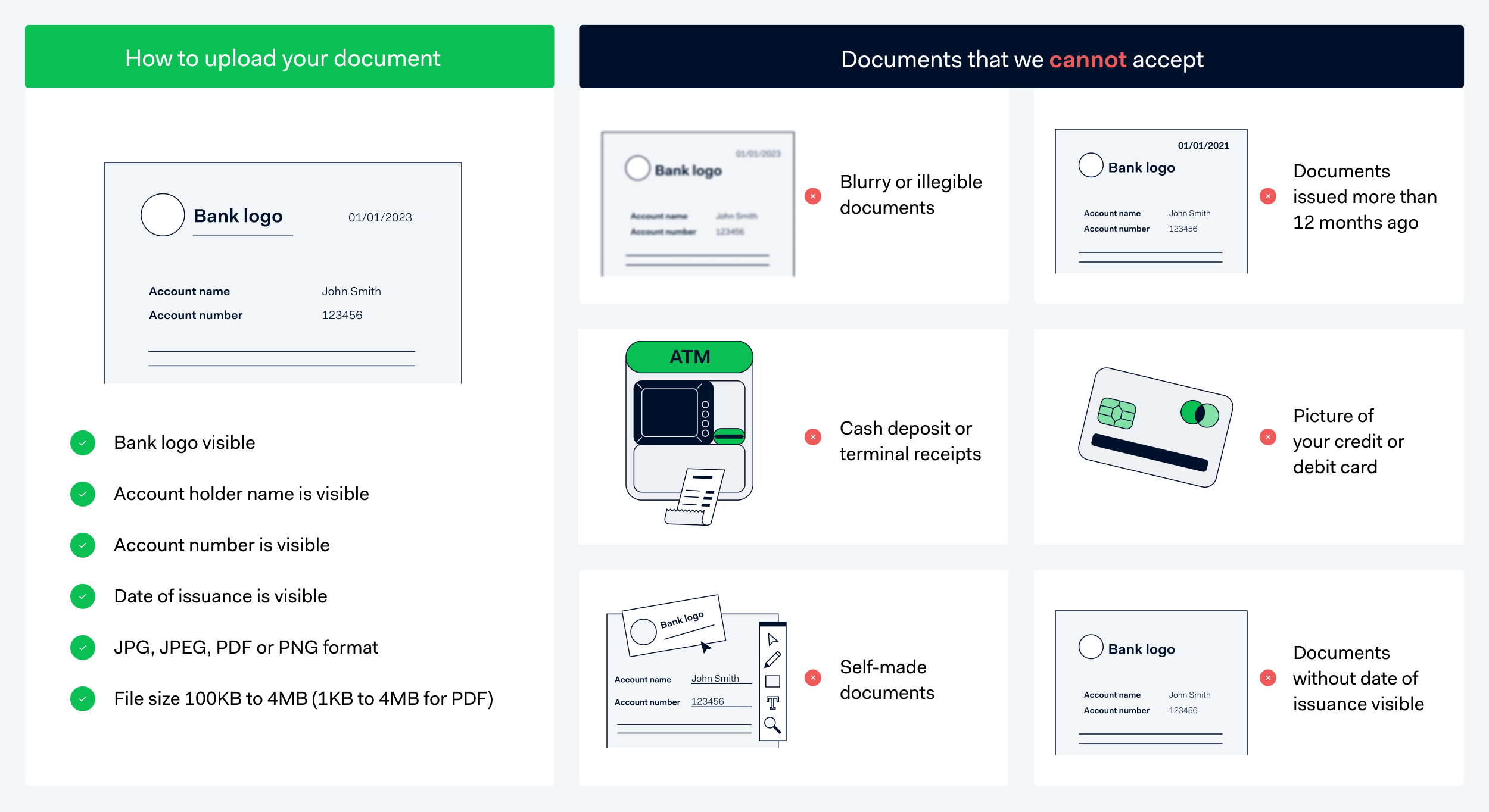

The document must show:

- The account holder name. This must match your legal entity name.

- The account number or IBAN

- The date of issuance needs to be visible and needs to be dated less than 12 months ago. This requirement applies to all types of documents except for RIBs, cheques, or TAMIEYTHPIO.

- The country where the bank account is located. For EU bank statements, Adyen infers the country from the IBAN.

- An indicator that the document was issued by a bank, such as the bank name, a bank logo or a bank-specific font.

File requirements:

- JPG, JPEG, PDF, or PNG (maximum 1 file)

- For PDFs: minimum 1 KB, maximum 4 MB

- For other formats: minimum 100 KB, maximum 4 MB

- Full color, cropped, and straightened image

What is an ultimate beneficial owner (UBO)? How is it different from a signatory?

Most companies have at least one ultimate beneficial owner (UBO), which is typically a person who owns 25% or more of the company. A UBO could also be someone who otherwise holds significant power in the company, such as controlling 25% or more voting rights. Often, UBOs are people like the CEO, CFO, President, Vice President, or members of the board.

If your company does not have a UBO, we need the information of an authorized signatory. This person has been granted official capacity to act or enter into a contract on behalf of the company.

Most UBOs are also signatories, but not all signatories are UBOs.

Can I receive payouts if I am a minor?

Adyen is unable to send payouts to minors below certain ages depending on their location of residence. These minimum ages are:

- 18 years old in Hong Kong and Singapore

- 16 years old in countries in the European Union (including Norway, Switzerland, and United Kingdom)

- 13 years old in all other countries/regions

Note that individuals under the age of 13 can never be onboarded.

Minors under the age of 18, but who are above the minimum age in their country/region, can receive payouts if a legal representative signs the Terms of Service on the minor’s behalf.