The Deposit is the amount withheld by Adyen to cover potential losses and liabilities due to payment processing. Adyen holds the deposit to protect you from settlement uncertainties in case of extreme scenarios, such as the COVID-19 pandemic for example. By holding the necessary funds, we can consistently maintain the cash outflow without having to block payouts during unforeseen events.

Unlike the reserve, you cannot determine your own deposit amount. Adyen calculates the deposit requirement for your account daily, based on variables such as your processing volume and the number of chargebacks and refunds. We can increase or decrease the deposit requirements based on changes in these variables.

If the deposit requirement increases, funds from your sales are booked to the deposit. If the deposit requirement decreases, the excess deposit is released and added to the next payout amount.

Check your deposit details

To check your deposit details, you need the user role:

- Merchant financial

To check your deposit details:

- Log in to your live Customer Area, and switch to the merchant account.

- Go to Finance > Balances (Merchant) > Deposit.

Why you need a deposit

As part of its acquiring operations, Adyen holds full financial responsibility for incoming chargebacks. When shoppers use their right for a chargeback via a chargeback-supporting payment method, Adyen deducts the related funds from your next payout.

However, it can happen that your account doesn't have enough funds available to cover the chargeback. For example, if you stop processing payments with Adyen. In this case, we use the deposit to cover the chargeback amount.

The funds held by Adyen as a deposit are exclusively owned by you. If you stop processing payments with Adyen, the deposit will be gradually paid back to you after the deduction of chargeback costs. As soon as Adyen has no more potential exposure to chargebacks, which is approximately six months after the processing has stopped, the remaining deposit will be returned to you.

How the deposit is calculated

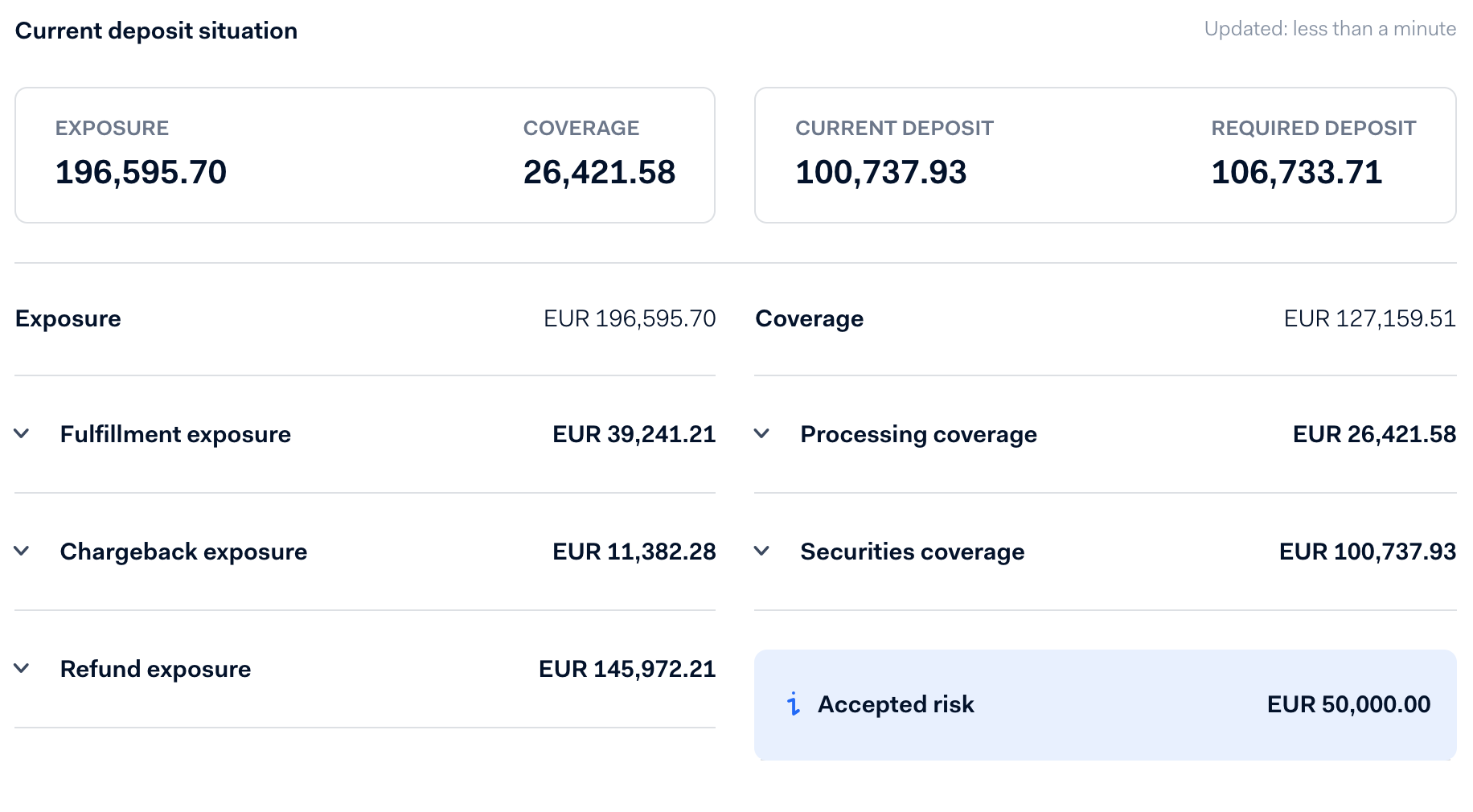

The deposit calculation is based on the difference between the potential exposure and available coverage.

- Exposure is a sum of estimated potential losses on your merchant account.

- Coverage is a sum of ways to cover these potential losses.

Adyen estimates the exposure that we have for your merchant account based on transaction data. This process always runs daily before the payout to ensure that the exposure on your merchant account does not exceed the current coverage by more than EUR10,000. If the total exposure exceeds the total coverage by more than EUR10,000, then Adyen automatically withholds funds from your next payout to cover the exposure.

The process ensures that if you stop processing with Adyen, then we can cover any potential losses related to your merchant account.

Calculation example

If the estimated exposure is EUR25,000, and the coverage is EUR18,000, then the above-mentioned threshold of EUR10,000 is not exceeded. So, we do not withhold any funds from your next payout and the required deposit remains unchanged.

However, if the exposure increases to EUR30,000, and the coverage is still EUR18,000, then the above-mentioned threshold of EUR10,000 is exceeded by EUR2,000. This means that the required deposit will be increased by EUR12,000 — the actual difference between the exposure and the coverage.

Exposure

Exposure consists of three components: fulfillment exposure, chargeback exposure, and refund exposure.

-

Fulfillment exposure

Fulfillment exposure is calculated based on the transactions that have been paid, but the product or service is delivered at a later date. The calculation incorporates the value of transactions processed through credit cards, direct debit, and Buy Now Pay Later (BNPL) during the order fulfillment time—the average number of days it takes for a product or service to be completely delivered to a shopper. -

Chargeback and refund exposure

Adyen uses a forward-looking method to calculate chargeback and refund exposure. This method uses historical data to predict how many chargebacks and refunds will happen in the future. This prediction is based on the past 180 days of data, which includes factors such as the timing and amount of reversals, as well as the likelihood of reversal over time.

Calculation

We consider the following factors when calculating chargeback and refund exposure:

- The expected reversal rate, which is based of the past 180 days of data to understand if, how often and when chargebacks and refunds occur.

- The total amount of payments that could potentially be reversed (chargebackable volume).

We multiply the expected reversal rate by the chargebackable volume to get an estimate of the chargeback and refund exposure.

Coverage

Coverage is composed of two components: processing coverage and securities coverage.

Processing coverage consists of your pending balance and payable balance. The processing coverage counts towards the required deposit and will be used to fill up the current deposit in case the required deposit increases.

-

Pending balance

The total amount of funds that are approved to be paid out to Adyen from card schemes and local payment methods on your behalf, meaning that they were successfully authorized and captured. Settlement timelines may vary based on the type of transaction. -

Payable balance

The total amount of funds received by Adyen from card schemes and local payment methods that have been settled and are about to be paid out to you. Note that in some cases, the payout can become negative.

Securities coverage corresponds to funds or instruments held by Adyen to offset the exposure after the deduction of processing coverage.

-

Bank guarantee

Adyen can accept a bank guarantee which can be used as a partial or full substitute to the deposit. However, bank guarantees are reviewed on a case-by-case basis. -

Actual deposit

This component corresponds to the part of the coverage that compensates for the difference between total exposure and total coverage.If the required deposit is higher than the actual deposit balance, funds will be deducted from your next payout until the required deposit amount is met.

-

Accepted risk

This component represents the exposure that Adyen accepts on a merchant account before increasing the deposit. The amount of accepted risk allocated to you is determined on a case-by-case basis, based on the analysis of your financial stability and volume of transactions.

Deposit types

Depending on the order fulfillment time and the type of industry you operate in, there are two models that can be applied to your deposit calculation:

-

Standard deposit

This deposit calculation uses a fixed fulfillment time assumption to calculate the fulfillment exposure. This approach is used for the majority of merchants processing with Adyen.

-

Delivery date deposit & airline date of travel deposit

The delivery date deposit and the airline date of travel deposit are used if you operate in industries where order fulfillment times can vary significantly. Such industries include but are not limited to ticketing, airlines, hospitality, car rental, and event planning.

When orders have different fulfillment times, it is difficult to accurately estimate the fulfillment exposure for a given merchant account. In these cases, we use a dynamic model to calculate the exposure of all unfulfilled transactions at a given time.

With this model of deposit calculation, we require you to send

deliveryDatewith each transaction which includes the date of the event. For example, a flight or a hotel check-in.

Optimize your deposit

The deposit is calculated algorithmically and is consistently applied to all merchant accounts. However, there are some ways you can optimize your deposit amount:

- Implement Unified Commerce

- Manage order fulfillment time

- Manage chargeback rates

- Supply a bank guarantee

Unified Commerce payment solution

You can implement Adyen's point-of-sale solution in addition to the ecommerce offering. Point-of-sale transactions have zero order fulfillment time and lower chargeback and refund rates.

Reduce order fulfillment time

You can reduce your deposit by limiting the period between the time the transaction is processed and the fulfillment of the related goods or services.

For example, by default, a monthly subscription service will have an order fulfillment time of 30 days. However, if you decide to bill shoppers at the end of the month instead of the beginning of the month, the order fulfillment time for the subscription will be zero.

To check your order fulfillment time:

- Log in to your live Customer Area, and switch to the merchant account.

- Go to Finance > Balances (Merchant) > Deposit.

Under Fulfillment exposure, you'll see Conf. delivery days.

If your fulfillment time Conf. delivery days differs from your actual fulfillment time, contact our Support Team.

Manage chargeback rates

You can reduce your exposure by limiting the number of chargebacks on your account. As chargeback exposure is based on historical chargeback data, a reduction in the chargeback rate will lead to a reduction in the deposit requirement.

This can be managed by enabling 3D Secure or changing the risk settings.

Supply a bank guarantee

You can manage your deposit requirement by supplying Adyen with a bank guarantee. A bank guarantee is equivalent to cash held in deposit.