This page is for classic Adyen for Platforms integrations. If you are just starting your implementation, refer to our new integration guide instead.

Adyen for Platforms is an end-to-end payment solution for peer-to-peer marketplaces, on-demand services, crowdfunding platforms, and any other platform business models.

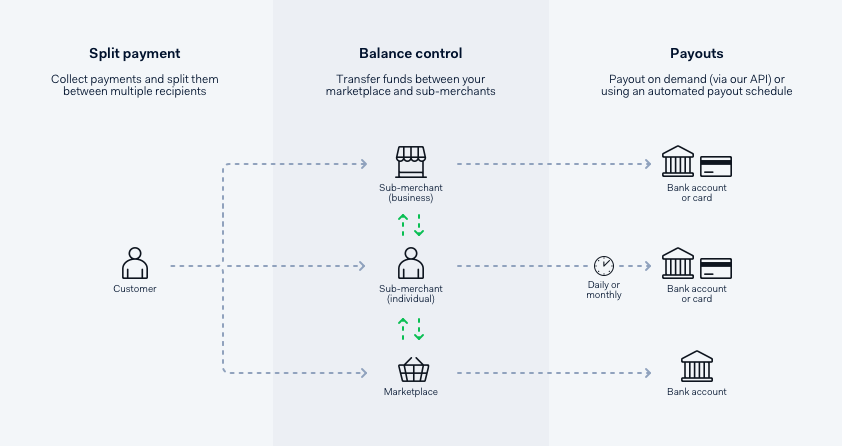

Our solution enables you to onboard sellers, service providers or contractors as sub-merchants and accept payments on their behalf. You can also split payments, transfer funds, and pay out to sub-merchants. You maintain complete control over the buyer and seller experience while staying ahead of new regulations, like PSD2, and the latest trends in payments, like real time payouts to cards.

With Adyen for Platforms, you can:

-

Onboard and verify account holders: Onboard sub-merchants as account holders and perform verification checks with our lightweight and flexible approach, or combine it with your own solution.

-

Process payments: Split payments between one or multiple sub-merchants, deduct costs as needed, and hold funds until payout.

-

Transfer funds: Securely transfer funds between your account and those of your sub-merchants.

-

Pay out: Decide when and how sub-merchants are paid, on demand or automated.

-

Reconcile transactions: Use Adyen-generated reports to build your platform's reconciliation processes.

Configure the payment flow to suit your business's needs, and customize it as products and services change or new ones are added.

Supported countries

Adyen for Platforms is available in several locations. You can onboard sub-merchants operating in any of the following countries.

| Asia Pacific |

|---|

Australia

Hong Kong

New Zealand

Singapore

| North America |

|---|

Canada

United States (including Puerto Rico)

| Europe |

|---|

Austria

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Latvia

Liechtenstein

Lithuania

Luxembourg

Malta

Netherlands

Norway

Poland

Portugal

Romania

Slovakia

Slovenia

Spain

Sweden

Switzerland

United Kingdom (including Isle of Man and Jersey)

If you plan to accept point-of-sale payments through Adyen for Platforms, the country in which you want to process point-of-sale payments must also be in the list of supported countries for our point-of-sale solution.

Onboard and verify account holders

Let sub-merchants sign up easily and at scale with a flexible and layered onboarding process:

-

Onboard businesses, non-profits, and individual sub-merchants in real time.

-

Retain full control over your platform's user experience.

-

Enable sub-merchants to start accepting payments immediately after signing up.

-

Let us perform the verification checks or use your own solution.

-

Use either a staggered or upfront verification approach.

For more information, see Onboard and verify users.

Process payments

For every payment, you can split funds between one or multiple sub-merchants and deduct various costs, such as commission, platform usage or payment fees.

The split of funds can be customized for every payment, which reduces your manual workload and streamlines internal processes. You can also let us safely hold funds until they need to be paid out to a sub-merchant.

You can offer customers a full range of payment methods, including all major card schemes and mobile wallets such as Apple Pay and Google Pay. We also support local payment methods like iDEAL in the Netherlands, and SEPA throughout the EU.

For more information, see Process payments.

Transfer funds

Moving funds around your platform and your sub-merchants can get complicated, especially if you are dealing with many sellers or using complex payment flows.

Our solution gives you the flexibility to debit or credit accounts on demand, as well as move funds between your platform and sub-merchant accounts.

You can even charge sub-merchants fees, such as subscription or chargeback fees, or credit their account with a bonus as and when needed.

For more information, see Transfer funds.

Pay out

Control the timing, method, and amount of every payout or automate the process entirely.

Automated payout schedules can be set up for each sub-merchant individually and modified via our API. Our Payout API enables you to send out payouts by specifying the amount and the account that needs to be debited for the payout.

We also support real time payouts to cards as well as regular bank payouts.

For more information, see Pay out to bank accounts and Pay out to cards.

Reconcile using reports

Adyen provides several reports that you can use for your platform's accounting, bookkeeping, and reconciliation processes.

You can use reports to:

- Reconcile your platform's accounts receivable.

- Build a transactional ledger.

- Understand fees.

For more information, refer to Reconcile transactions using reports.