Hosted Payment Pages are no longer available

To accept payments through an Adyen-hosted page, use our Hosted Checkout.

This page is for the classic Hosted Payment Pages (HPP) integration, which has reached end-of-life. We are no longer processing transactions though HPP.

The Bankers' Automated Clearing Services (BACS) is used for electronic processing of financial transactions within the UK.

Direct debits are protected by the Direct Debit Guarantee which provides safeguards to the shopper including:

-

An immediate money back guarantee from the bank in the event that an error is made in the payment of a Direct Debit.

-

A new advance notice in case the date or amount changes.

-

The right to cancel the Direct Debit Instruction at any time.

-

The money back guarantee is only applicable to erroneous direct debit payment. It cannot be used to in case of contractual disputes with the customer. The customer may change or cancel the direct debit at any time by contacting the bank, service user or merchant. In case of an error with a direct debit, the customers bank refund the shopper under the terms of the Direct Debit Guarantee via the indemnity claim process. Direct Debit indemnity claims are processed electronically from banks to the service users and must be settled within 14 working days.

Direct Debits may be returned as unpaid by the paying bank when:

-

The paying bank gives advice to the service user of a change of circumstances to the DDI (e.g. Instruction cancelled).

-

The payer disputes the due date, amount or frequency of a Direct Debit.

-

The paying bank is referring the collection back to the service user as a notification of non-payment e.g. 'Refer to payer'.

-

The unpaid direct debits also include the returns for transactions that can not be collected, e.g. due to insufficient funds on the shopper's account. The customer's bank might charge an additional fee for unpaid direct debits to the payer. An unpaid Direct Debit is debited from a service user's account within 3 working days after the entry day and booked as a chargeback accordingly with the reason code provided by the paying bank. Hence, Adyen expects utmost care of merchants using the BACS service to reduce the returned items.

Transaction flow

BACS transactions are processed via the domestic GBP bank account held by Adyen. Adyen provides full reconciliation service and settles the transaction to the merchant's account accordingly.

Flow:

- The shopper initiates the original payment via the payment pages by providing account and address details.

- The address details can be provided in the payment request sent to Adyen so these do not have to be provided on payment pages. The original payment can be submitted to Adyen as a recurring transaction, so future direct debits can automatically be collected via recurring payments.

- The account details for the payments are validated to make sure that the bank branch is existing and the account number is valid for the bank sort code. As an additional service, payments can also be verified where the ownership of the bank account is confirmed via the account owner name and address details.

- AUDDIS submission: If the payment details are valid, a DDI is generated and submitted by Adyen via AUDDIS (AutomatedDirectDebitInstructionService) to send to the bank for registration.

- DDI confirmation and advance notice (Adjust the DDI setup/registration section)

- The payment is not authorized immediately. After receiving, the payment is booked as authorized and settled after the payment is confirmed by BACS. On completion of the payment session, a response is sent to the merchant, the merchant needs to send a confirmation that the DDI is setup, then the account is debited accordingly.

- BACS submission: It typically takes several business days for the bank to register the DDI's that have been submitted via AUDDIS. So, the actual direct debit to BACS is submitted with a delay. After the BACS file with direct debits is submitted to BACS, the payment enters a 3-day cycle before the amount is debited from the shopper's account (day 1: Input day, day 2: Processing day and day 3: Entry day).

- After the successful registration, the payment is authorized.

- After the Direct Debit Instruction is setup, the actual capture/collection of the payment is created and send to BACS.

- Settlement and Reconciliation: The payment is credited to the merchant on the same day as the collection is debited from the shopper's account and is reconciled accordingly.

Refunds:

The merchant can submit a refund when they want to refund the payment to the shopper. Else, the refund with Adyen is linked to the original transaction, BACS processes the refund as a separate payment. For this reason, a possibility is that the transaction is refunded by the merchant and is returned by shopper via their bank accordingly.

- Chargebacks and amendments (ADD)

- As per the Direct Debit Guarantee BACS direct debit, payments can be returned. The payment can also be returned as unpaid by the banks. Several reasons that are sent with the chargeback to the merchant but the defend disputed/returned transactions process is not available.

Payment response

After the shopper completes a payment, they are redirected to the merchant's website and a result URL based on merchant configuration is created. A webhook event regarding the status of the transaction is sent to the merchant.

See HPP payment response for more information.

After the shopper completes a payment, they are redirected to the merchant's website and a result URL based on merchant configuration is created.

A webhook event regarding the status of the transaction containing the following fields is sent to the merchant:

The webhook event is sent by PAL/PSP or both.

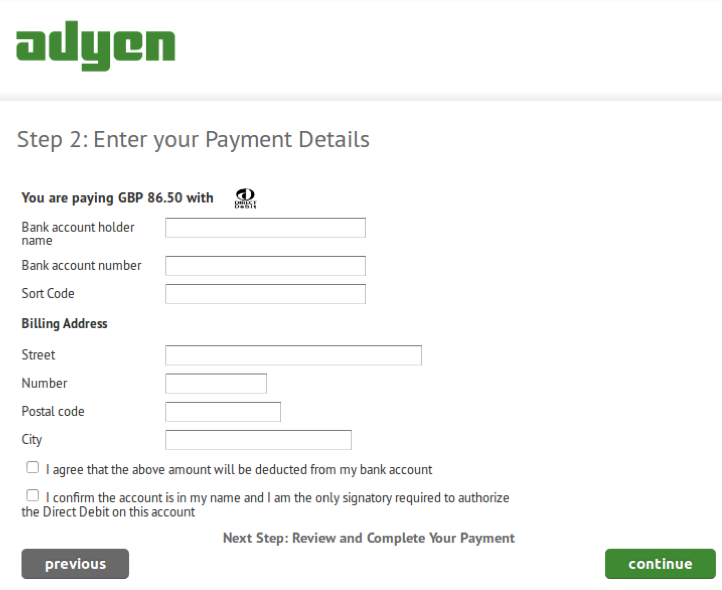

Design of payment form

When designing your online payment form there are some mandatory requirements you need to be followed:

- Two checkboxes to confirm that the shopper agrees with the amount to be debited, and the shopper is the only signatory required to authorize the direct debit in the provided account.

- You need to show that Adyen Payments processes the direct debit and appears on their bank statement against the direct debit. Adyen processes the direct debit using Service User Number 298288.

- You must provide the e-mail, of your customer service, and telephone, local (GB) phone number, after the payment is accepted.

All these requirements are already available by default if you decided to use our HPP solution.

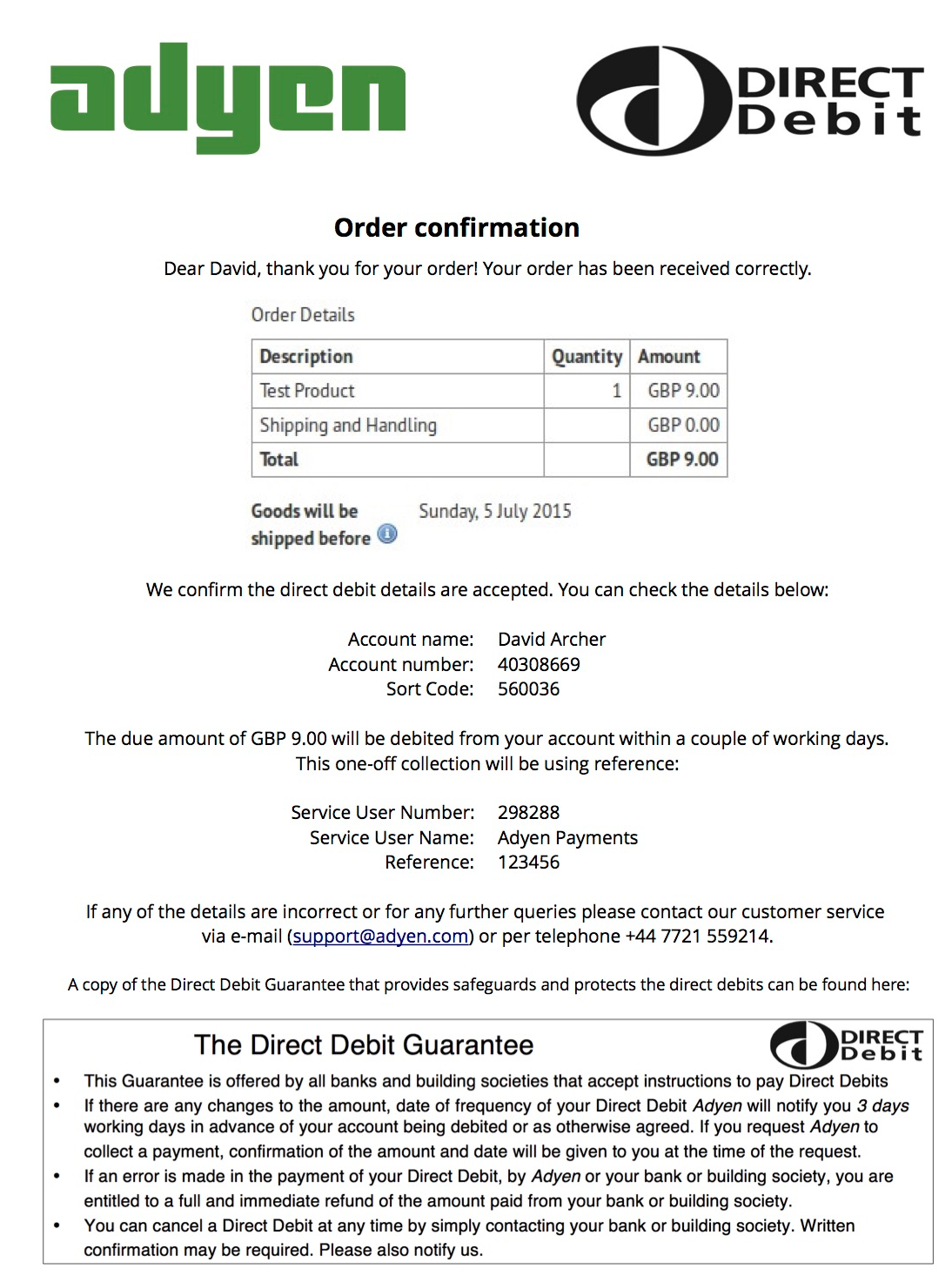

The merchant should send a confirmation and advance notice to the shopper before the actual capture, for each payment, including the following values:

Confirmation letter

| Value | Description |

|---|---|

|

Sort Code |

Initial digits of bank sort codes are allocated to settlement members of the banking industry in the United Kingdom.These bank codes are used to route transfer between banks.These numbers are six digits long, formatted into three pairs which are separated by hyphens. |

|

Account name |

Name of the account holder which can be a consumer or a business. |

|

Account number |

Account number. |

|

Service User Number |

A service user number (SUN) is a unique six digit number that BACS uses to identify originating institutions. The service user number assigned to Adyen which is used for processing your BACS payments is 298288 |

|

Service User Name |

The service user name is the name of the originating institution and is shown on the shopper's/beneficiary's bank statement. The service user name that is shown against your BACS payments is Adyen Payments. |

|

Reference (DDI) |

DDI reference (mandateId) is a reference related to the mandate/recurring contract.The DDI reference from the service user is unique to the shopper and appears for all direct debits. Recurring payment contains the DDI reference was originally submitted with the initial transactions followed by a unique payment reference.A six digit DDI reference is given in the statement and an eleven digit unique payment reference separated by a full-stop. |

Advance notice

In case of recurring contract.

| Value | Description |

|---|---|

|

Amount to be debited |

The amount that was submitted in the payment request to Adyen is debited. |

|

Frequency |

Recurring payments frequency where shopper's account is debited on a weekly, monthly or yearly basis. The shopper should be informed about the payment frequency related to the direct debit commitment. |

|

Date to be debited |

Shoppers should be informed about the upcoming debit from their account. The initial payment is debited within 5 business days as the DDI need to be registered with the bank first before the direct debit can be cleared.Recurring payments are debited within 3 business days. |

|

Advance notice period |

Shoppers should be informed about the upcoming debit by providing the direct debit details at least 3 working days before the debit is cleared on the account. |

Webhooks

We send webhooks events to keep you updated on the transaction status.

Pending

These webhook event are sent out at the payment creation moment.

The pending webhook events are not enabled by default. To configure this in the Customer Area, go to Developers > Webhooks and click Add next to Direct-Debit Pending.

{

"live":"false",

"notificationItems":[

{

"NotificationRequestItem":{

"additionalData":{

"directdebit_GB.mandateId":"424544",

"directdebit_GB.serviceUserNumber":"298288",

"directdebit_GB.serviceUserName":"Adyen Payments",

"directdebit_GB.sequenceType":"OneOff",

"directdebit_GB.dateOfSignature":"2016-10-21"

},

"amount":{

"currency":"GBP",

"value":1000

},

"eventCode":"PENDING",

"eventDate":"2016-10-21T11:34:15+02:00",

"merchantAccountCode":"YOUR_MERCHANT_ACCOUNT",

"merchantReference":"TMRef1234",

"paymentMethod":"directdebit_GB",

"pspReference":"9914770424540842",

"success":"true"

}

}

]

}Authorise

{

"live":"false",

"notificationItems":[

{

"NotificationRequestItem":{

"additionalData":{

"directdebit_GB.mandateId":"424544",

"directdebit_GB.serviceUserNumber":"298288",

"directdebit_GB.serviceUserName":"Adyen Payments",

"directdebit_GB.sequenceType":"OneOff",

"directdebit_GB.dateOfSignature":"2016-10-21"

},

"amount":{

"currency":"GBP",

"value":1000

},

"eventCode":"AUTHORISATION",

"eventDate":"2016-10-21T11:34:15+02:00",

"merchantAccountCode":"YOUR_MERCHANT_ACCOUNT",

"merchantReference":"TMRef1234",

"paymentMethod":"directdebit_GB",

"pspReference":"9914770424540842",

"success":"true"

}

}

]

}