eftpos (electronic funds transfer at point of sale) is Australia's local debit card scheme. It is available for in-person as well as online payments. Most eftpos cards are co-badged with an international card scheme, for example with Mastercard, Visa, or China UnionPay.

You can find the eftpos scheme rules in your Customer Area. Select the Notification icon on the top right, and select Scheme rules.

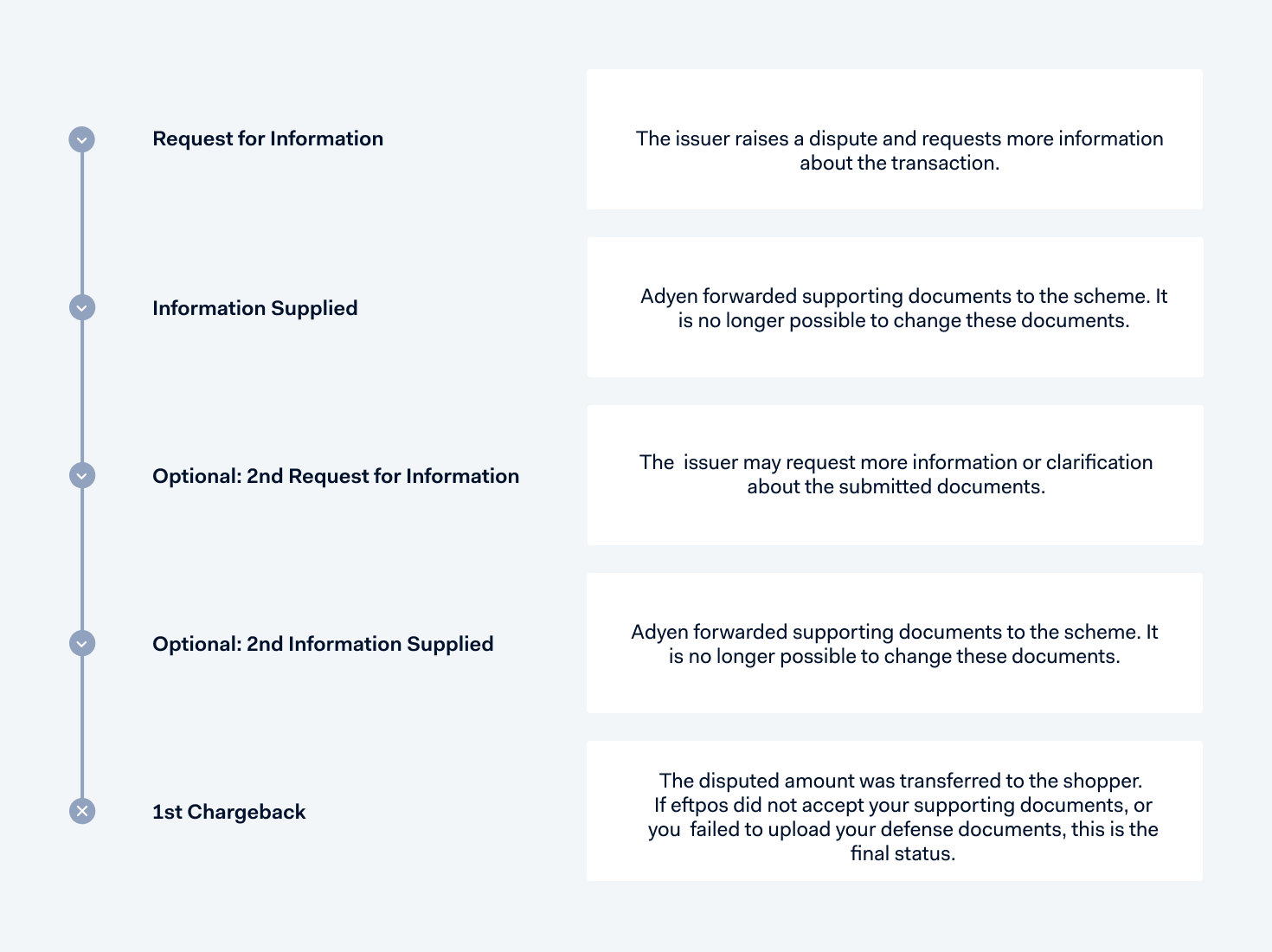

The chargeback flow for eftpos consists of the following steps:

- Request for Information

- Information Supplied

- Optional: 2nd Request for Information

- Optional: 2nd Information Supplied

- 1st Chargeback

To manage this eftpos chargeback flow, you can:

- Use the Disputes API.

- Use the Customer Area.

eftpos flow

Request for Information (RFI)

A Request For Information (RFI) is initiated when the cardholder does not recognize or does not agree to a charge, and requests more information from their bank. It can also be initiated in the context of a fraud investigation where the real cardholder does not acknowledge the transaction.

For an RFI, always upload information that can help the cardholder to recognize the charge or that can support your position that the transaction is valid.

At this point, funds are not yet deducted from your account.

If you have subscribed to receive Customer Area notifications, you will be notified by email about the incoming RFIs. Alternatively, you can find the list of RFIs in your Customer Area by going to Revenue & risk > Disputes > Requests for Information.

You have 14 days to respond to an RFI.

It is mandatory to respond to the RFI. If you do not respond within the specified time, you will receive a chargeback. You cannot defend the chargeback and that is the final status of the dispute.

Information Supplied

Adyen received your defense documents and forwarded them to the scheme. It is no longer possible to change these documents. The InformationSupplied journal is booked and we send you an INFORMATION_SUPPLIED webhook.

The issuer has 10 days to review your defense documents.

If the issuer accepts your defense, this is the final status of the dispute.

Optional: 2nd Request for Information (RFI)

If the issuer rejects the defense documents that you provided during the first RFI stage, they will request more information about the dispute, and you will receive a second RFI.

You have 5 days to respond to the second RFI.

It is mandatory to respond to the second RFI. If you do not respond within the specified time, you will receive a chargeback. You cannot defend the chargeback, and that is the final status of the dispute.

Optional: 2nd Information Supplied

Adyen received your defense documents and forwarded them to the scheme. It is no longer possible to change these documents. The InformationSupplied journal is booked and we send you an INFORMATION_SUPPLIED webhook.

The issuer has 7 days to review your defense documents.

If the issuer accepts your defense, this is the final status of the dispute.

1st Chargeback

If the issuer rejects your defense, or if you failed to provide the defense documents in time, you will receive a chargeback. The Chargeback journal is booked, and your account is debited for the chargeback amount.

You cannot defend this chargeback, and this is the final status of the dispute.

Manage chargebacks using the Disputes API

If you have integrated our Disputes API, you receive a dispute webhook when a shopper starts a dispute process with their issuer. Using the API, you can manage the eftpos dispute flow.

Manage chargebacks in the Customer Area

In your Customer Area, you can view disputes, and manage the eftpos dispute flow.

Reason codes and guidelines

For a list of eftpos Request for Information reason codes, see Dispute reason codes.