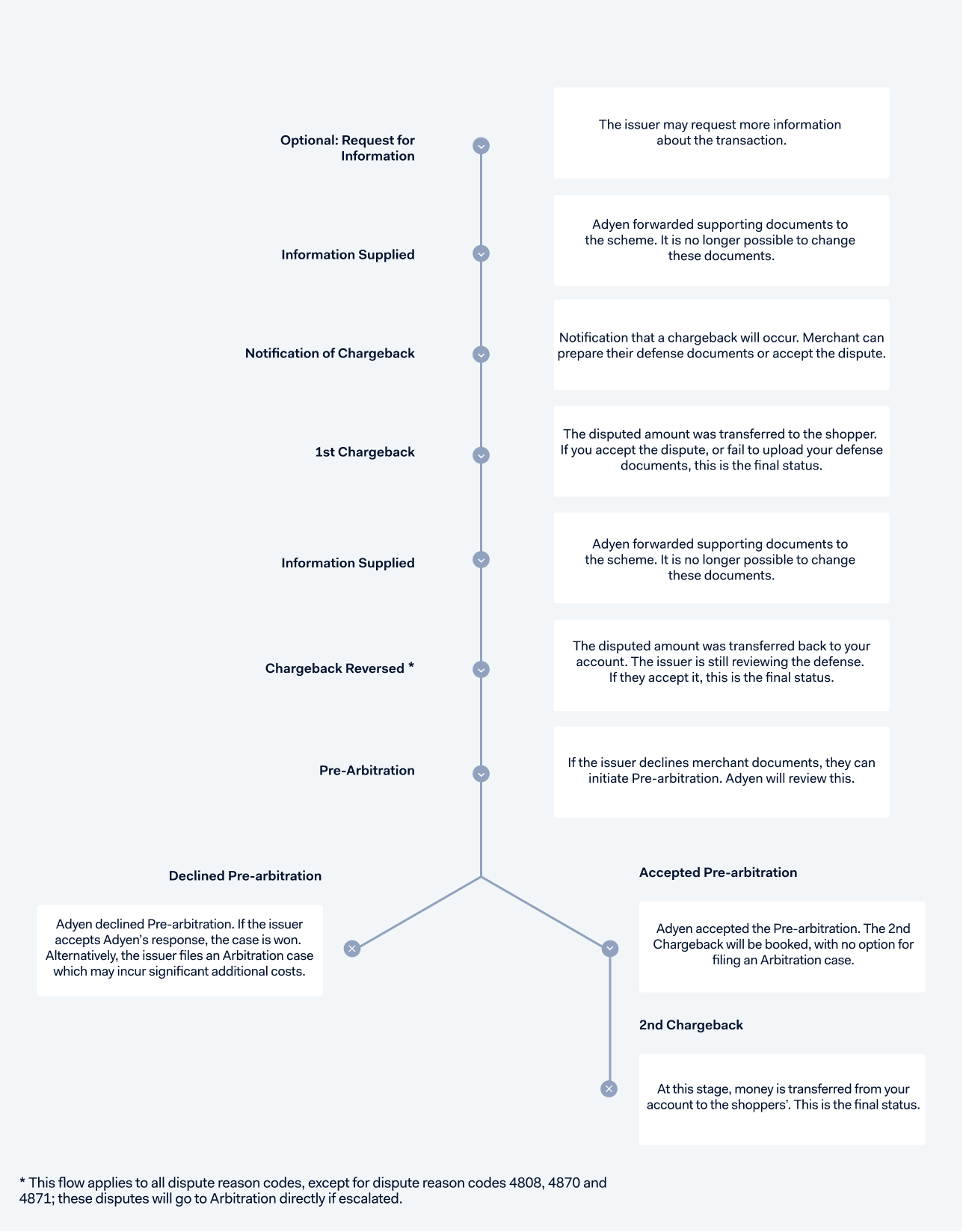

In the Mastercard chargeback process, an issuer can escalate a dispute and file a Pre-Arbitration case. This applies to all Mastercard reason codes, except 4808, 4870, and 4871; these disputes will go to Arbitration directly if escalated.

The Mastercard chargeback flow:

- Optional: Request for Information (Deprecated)

- Information Supplied

- Notification of Chargeback

- 1st Chargeback

- Information Supplied

- Chargeback Reversed

- Pre-Arbitration

- 2nd Chargeback

- Arbitration

Mastercard flow

Optional: Request for Information (RFI) (Deprecated)

From mid October 2021, Mastercard stopped using the Request for Information stage. The dispute process starts with a Notification of Chargeback.

A Request For Information (RFI) is initiated when the cardholder does not recognize or does not agree to a charge, and requests more information from their bank. It can also be initiated in the context of a fraud investigation where the real cardholder does not acknowledge the transaction.

For an RFI, always upload information that can help the cardholder to recognize the charge or that can support your position that the transaction is valid.

At this point, funds are not yet deducted from your account.

Information Supplied

Mastercard stopped using the Request for Information stage.

For any open RFIs, upload the information within 18 days of the RFI date.

Notification of Chargeback

The issuing bank initiated a Notification of Chargeback (NoC). The NoC can follow from a Request for Information (RFI), or the RFI step is skipped and the NoC occurs immediately after the payment status is set to Settled or Refunded. We send you a NOTIFICATION_OF_CHARGEBACK webhook. The dispute process has started, and money will be withdrawn from your account.

The chargeback debit usually occurs a few days after you receive the NoC.

1st Chargeback

The issuing bank initiates the first chargeback on behalf of the cardholder by sending a chargeback notification to Adyen stating the dispute reason.

We assign the dispute to you for review in your Customer Area > Revenue & risk > Disputes. The NotificationOfChargeback and Chargeback journals are booked, and we send you a CHARGEBACK webhook. At the same time, your account is debited for the chargeback amount.

After your review, you can decide to either:

- Accept the chargeback in your Customer Area or using the Disputes API. The case will be closed for defense.

-

Defend the dispute. You need to upload the relevant defense documents in your Customer Area or using the Disputes API.

See Defense requirements for file formats and for defense documents per dispute type. Be sure to address the dispute reason and provide information that supports your position. An overview of the order details is not enough.You must provide your defense documents within 40 days. There is no opportunity later in the process to provide information or to update information you provided.

Contact Adyen with the relevant defense documents within 40 days. There is no opportunity later in the process to provide information, unless this information was not available before.

Therefore, address the dispute reason code and upload information that can support your position. Only uploading an overview of the order details is not enough. Refer to the list of Mastercard dispute reason codes.

Submitting the defense documents is irreversible. The documents are automatically sent back to the issuing bank, through the credit card network.

Information Supplied

Adyen received your defense documents and forwarded them to the scheme. It is no longer possible to change these documents. The InformationSupplied journal is booked and we send you an INFORMATION_SUPPLIED webhook.

Chargeback Reversed

The journal Chargeback reversed is booked and the disputed amount is transferred back into your account. The issuer is still reviewing the defense. If they accept, this is the final status.

If they do not accept, disputes with reason codes 4808, 4870, or 4871 go straight to Arbitration.

Pre-Arbitration

If the issuer finds the defense not compelling enough, they escalate the dispute by filing a Pre-Arbitration case within 45 days of the date that the defense was uploaded (the Information Supplied date). Pre-Arbitration applies to all reason codes, except 4808, 4870 and 4871; these disputes go to Arbitration directly if escalated by the issuer.

Adyen reviews the Pre-Arbitration case and either accepts or declines. If Adyen accepts, a Second Chargeback takes place, and the issuer no longer has the option to file an Arbitration case. If Adyen declines, the issuer has the option to file an Arbitration case.

2nd Chargeback

If Adyen accepted the issuer's Pre-Arbitration case, a second chargeback occurs. You cannot upload defense documents. This is the final status.

Arbitration

If Adyen declined the Pre-Arbitration and the issuer accepts our response, the case is won. If the issuer doesn't agree with the response, they have the option to file an Arbitration case. This means the dispute is escalated to the card scheme.

Also, escalated disputes with reason codes 4808, 4870, or 4871 go straight to Arbitration.

Arbitration may lead to significant additional costs. The outcome of the Arbitration is decided by Mastercard.

Adyen is not responsible if the card scheme rules in favor of the cardholder.