Klarna is a guaranteed payment method for business models with physical goods. Klarna pays you upfront and assumes the risk of non-payment by the shopper, but only if you meet Klarna's order fulfillment rules. For example, a shopper can dispute a charge if the goods were not delivered or if the delivered goods were faulty. If you do not follow the Klarna scheme rules, Klarna has the right to charge back the payment.

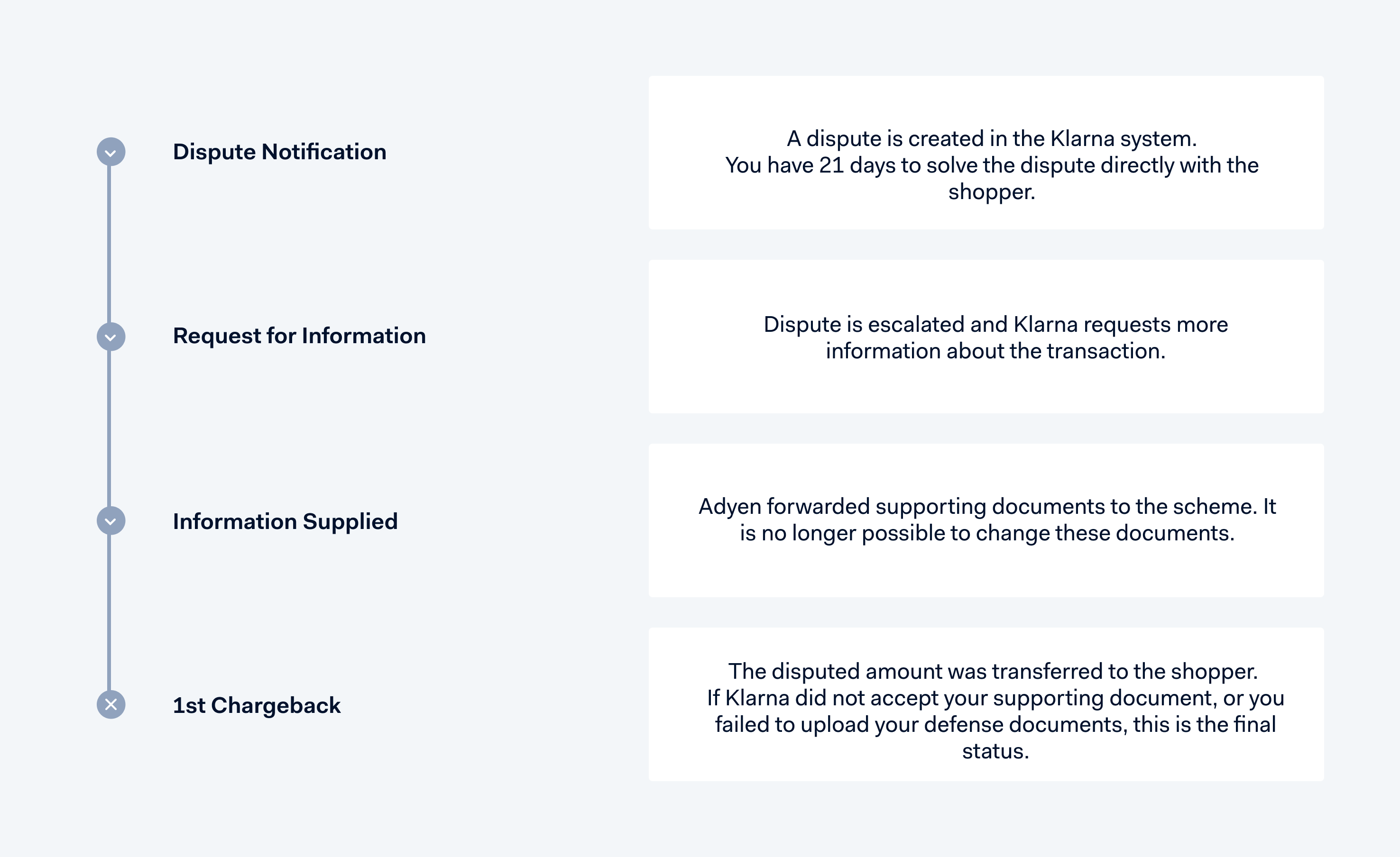

The Klarna chargeback flow involves the stages Dispute Notification, Request for Information (RFI), Information Supplied, and 1st Chargeback.

To manage this Klarna chargeback flow, you can:

- Use the Disputes API.

- Use the Customer Area.

Klarna flow

Dispute Notification

When a shopper raises a complaint, Klarna creates a dispute notification. You have 21 days to contact the shopper and resolve the complaint. For returns, the time period is 7 days. If you cannot resolve the complaint with the shopper within that time period, Klarna will escalate the complaint to a Request for Information.

Disputes for unauthorized purchases and high risk orders must be addressed promptly. Therefore, they are escalated to a Request for Information much faster, within days or even hours after receiving a Dispute Notification.

To inform you of a Dispute Notification:

-

We send you a Request for Information dispute webhook. The reason code includes

notificationto indicate this is a Dispute Notification and not a Request for Information. For example,notification_goods_not_receivedfor a Dispute Notification, compared togoods_not_receivedfor a Request for Information. -

In your Customer Area we show the complaint under Revenue & risk > Disputes > Requests for Information. To indicate this is a Dispute Notification and not a Request for Information, the description of the dispute reason starts with NOTIFICATION. For example, [NOTIFICATION] The user informed that the invoice is incorrect.

The following table shows the reason codes you can expect for Dispute Notifications.

| Dispute reason code | Description |

|---|---|

notification_return |

The shopper reported that they made a full or partial return. Adyen only creates return dispute notifications if the dispute is still open 14 days after the dispute event is created. |

notification_goods_not_received |

The shopper reported that they did not receive the full or partial order. |

notification_faulty_goods |

The shopper reported that they received faulty goods. |

notification_already_paid |

The shopper reported that they already paid directly to the merchant, instead of paying via Klarna. |

notification_incorrect_invoice |

The shopper reported that the invoice is incorrect. |

notification_pandemic_impact |

The shopper reported that the order was canceled due to COVID-19 circumstances. |

notification_unauthorized_purchase |

The shopper reported that the order was placed by someone with unauthorized access to their account. |

notification_high_risk_order |

Klarna suspects this to be fraudulent order, where a shopper's personal details, for example, their payment information, were wrongfully used. |

Request for Information

If the dispute is not resolved in time, Klarna escalates the dispute to a Request for Information (RFI). Unlike other payment methods, uploading the requested information is mandatory with Klarna.

You need to respond to an Request for Information within:

- 96 hours for the dispute reason code

high_risk_order. - 7 days for the dispute reason code

unauthorized_purchase. - 14 days for other dispute reason codes.

If you do not respond to the Request for Information in time, a chargeback can take place where money will be deducted from the next payable batch.

To inform you of a Request for Information:

-

We send you a Request for Information dispute webhook.

-

In your Customer Area we show the complaint under Revenue & risk > Disputes > Requests for Information.

Request for Information reason codes

The following table shows the reason codes you can expect for a Request for Information.

| Dispute reason code | Description |

|---|---|

return |

The shopper reported that they made a full or partial return. |

goods_not_received |

The shopper reported that they did not receive the order fully or partially. |

faulty_goods |

The shopper reported that they received faulty goods. |

already_paid |

The shopper reported that they already paid directly to the merchant, instead of paying via Klarna. |

incorrect_invoice |

The shopper reported that the invoice is incorrect. |

pandemic_impact |

The shopper reported that the order was cancelled due to COVID-19 circumstances. |

unauthorized_purchase |

The shopper reported that the order was placed by someone with unauthorized access to their account. |

high_risk_order |

Klarna suspects this to be fraudulent order, where a shopper's personal details, for example, their payment information, were wrongfully used. |

Respond to an RFI

If you do not agree with the RFI dispute, you can try to defend it. Note that you have only one attempt to submit all the necessary information. After that, it is no longer possible to make any changes to the documents. To defend the dispute, you need to:

-

Provide your defense documents. For each case, there is a template for you to fill in:

-

After filling in the template, save the document as a PDF file.

-

Submit the PDF file using our Disputes API or the Customer Area.

Information Supplied

Adyen received your defense documents and forwarded them to the scheme. It is no longer possible to change these documents. The InformationSupplied journal is booked and we send you an INFORMATION_SUPPLIED webhook.

Based on the information you provided, Klarna assesses the dispute and makes a decision:

- If Klarna accepts your defense, no further journals are booked, and this is the final status.

- If Klarna rejects your defense, you will receive a chargeback.

1st Chargeback

Klarna resolves the dispute in the shopper's favor, and initiates a chargeback. The Chargeback journal is booked, your account is debited, and you receive a CHARGEBACK webhook.

You cannot defend this chargeback. This is the final status, and the dispute is lost.

Managing chargebacks

You can manage the Klarna chargeback flow using the Disputes API or your Customer Area.

The Klarna documentation has more information about Klarna disputes.

Discontinued email notification

From May 1, 2023, you no longer receive an email about stop requests by Klarna. Instead, these are reported as a Request for Information (RFI) with the reason code high_risk_order. Resolve these RFIs through the Disputes API or your Customer Area using the correct defense template.

Manage chargebacks using the Disputes API

If you have integrated our Disputes API, you receive a dispute webhook when a shopper starts a dispute process with their issuer. Using the API, you can manage the Klarna chargeback flow for the disputed payment.

Manage chargebacks in the Customer Area

In your Customer Area, you can view disputes, and manage the four stages of a Klarna chargeback flow for a disputed payment.