Dynamic Currency Conversion allows your shoppers to pay in their home currency when using Visa and Mastercard. The terminal must be configured to allow DCC.

Contact Support Team to enable this setting.

When the terminal detects a card with a default currency that differs from the merchant's currency, it offers DCC to the shopper. The terminal shows full details of the exchange rate to the shopper to help the shopper decide whether to convert. The same information is displayed on the cash register for the merchant.

The shopper either accepts or rejects the DCC offer and proceeds with the selected amount and currency. If DCC is selected, related information is shown on the receipt.

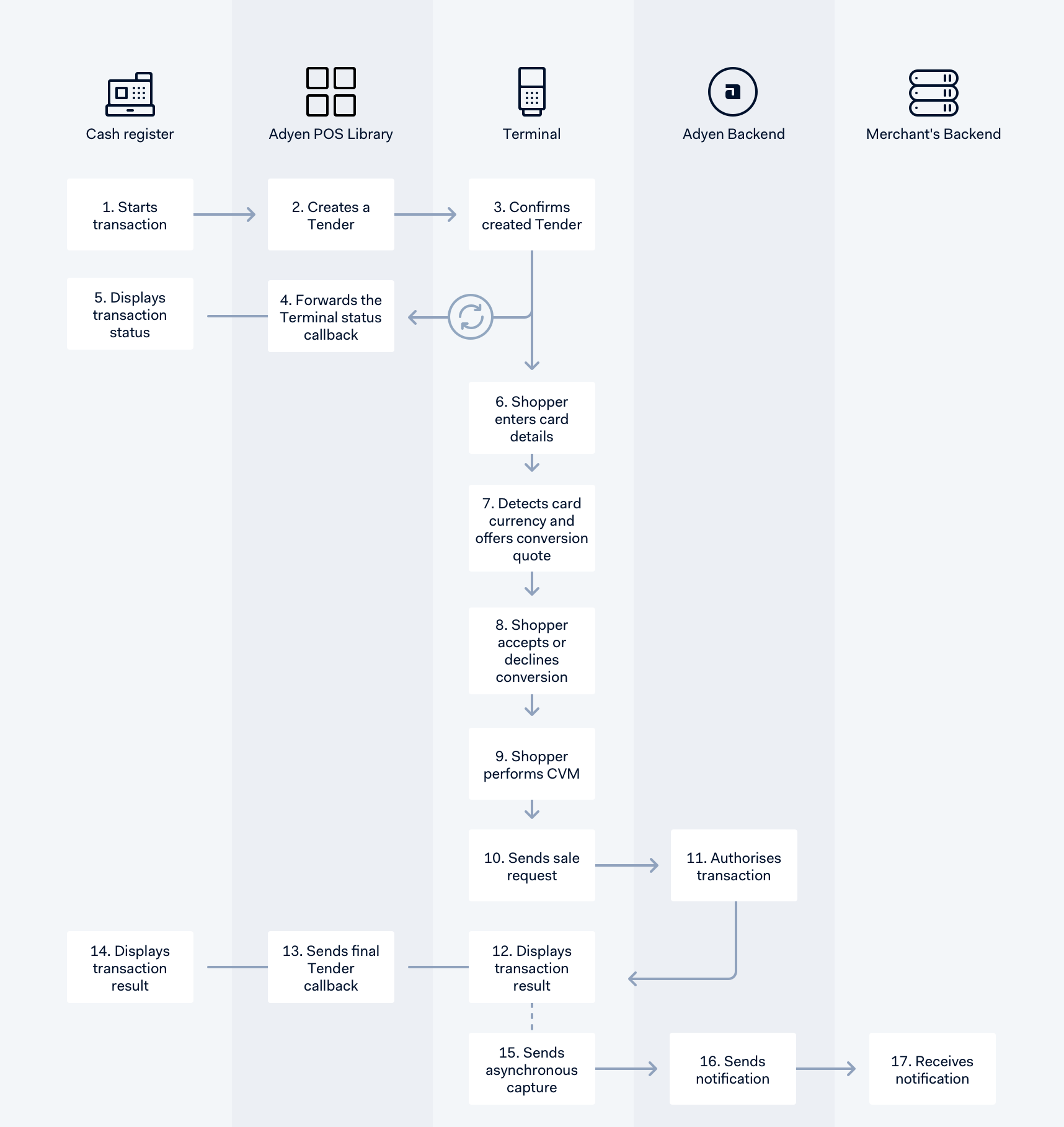

Process flow

-

Associate enters amount, currency and merchant reference and starts a transaction.

-

The terminal shows amount and currency and asks the shopper to insert/swipe card.

-

The shopper inserts or swipes their card.

-

The merchant account may be configured to accept DCC.

-

After the card is swiped or inserted, the country/region of origin is known, and the currency of the shopper is offered. DCC quote is shown on the PED.

-

If the shopper accepts the DCC quote, the transaction continues in the chosen (shoppers) currency.

-

If the shopper declines the DCC quote, the transaction continues in the merchants currency.

-

After the card is presented to the terminal, the Customer Verification Method (CVM) method is determined. Common CVM methods are signature capture or PIN entry:

-

CVM is PIN entry.

- For EMV transactions, the flow continues if the PIN is valid. If the entered PIN is not valid, the terminal prompts the shopper to retry up to three times. If three attempts are unsuccessful the terminal shows a message to the shopper.

-

CVM is signature.

-

The signature can be captured on a screen or paper.

-

For capture on screen: a terminal with touch screen has to be set up through Adyen's Customer Area. If the signature is unsuccessful, the tender cannot be authorized.

-

For capture on paper: a merchant copy of the receipt is printed, the shopper can sign on the receipt. The cashier should accept or deny the signature: if the signature is not accepted, the tender cannot be authorized.

-

-

-

-

The terminal sends an authorization request, after cardholder verification is secured.

-

The plataforma de pagamentos da Adyen sends Authorization response to the terminal.

-

The terminal receives transaction results from the plataforma de pagamentos da Adyen.

-

The POS library sends the final result callback to the cash register. The result can be: Approved, Declined, Cancelled or Error.

-

The cash register receives the final result from the transaction.