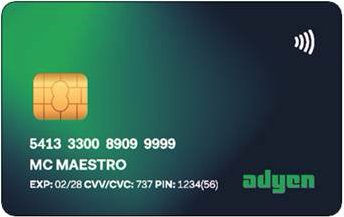

This Adyen test card has several "applications" programmed onto it that each simulate a specific card brand (payment method), language, country/region, and currency, and various Cardholder Verification Methods (CVM).

It supports contactless, offline, and installment transactions.

When making test payments with this card:

- To test a specific application on the test card, use the corresponding currency in your payment request.

- To test different CVMs, use different combinations of transaction amount and currency.

- To test declined payments, use the last three digits of the transaction amount.

You can view the details of test payments in your test Customer Area under Transactions > Payments.

The test card simulates Mastercard and Maestro payment methods. To verify that your POS app and terminal are communicating as expected and to test your reconciliation, no other card payment methods are needed. But as an alternative, you can order test card packs from B2PS.

To test contactless payments as well as Tap to Pay on mobile with this card, you must use the card version 2.4 or later. The version is specified on the back of the test card above the magnetic stripe.

Card applications

Use the table below to see which application on the test card corresponds with the scenario you want to test.

To try a particular application, use the corresponding currency in your payment request. You can also select an application on the terminal: when the terminal shows Present card, insert the card and select the application on the display.

| Application | Payment method | Locale | Issuing country/region | Currency | Expiration date | Cardholder | PIN | PAN | AID |

|---|---|---|---|---|---|---|---|---|---|

| mc en gbr gbp | Mastercard | English | UK | GBP | 02/28 | AD YEN-UK | 1234 | 5413 3300 8909 9999 | A0000000041010 |

| mc en usa usd | Mastercard | English | US | USD | 12/29 | AD YEN-US | 1234 | 5100 0600 0000 0002 | A0000000041010 |

| ms nl nld eur | Maestro | Dutch | NL | EUR | 03/30 | AD YEN-NL | 1234 | 6000 0707 3616 9237 003 | A0000000043060 |

| mc en aus aud | Mastercard | English | AU | AUD | 12/29 | AD YEN-AU | 1234 | 5520 3300 0000 0001 | A0000000041010 |

| mc cn chn cny | Mastercard | Chinese | CN | CNY | 12/29 | AD YEN-CN | 123456 | 6243 0300 0000 0001 | A0000000041010 |

| mc pt bra brl | Mastercard | Portuguese | BR | BRL | 12/29 | AD YEN-BR | 1234 | 2308 8800 0000 0000 | A0000000041010 |

| MSR | Visa | 03/30 | MSR AD YEN-VISA | 4151 5000 0000 0008 |

Application mc pt bra brl allows you to test Brazil installment payments.

Testing CVMs

When you make payments with the test card, a CVM is triggered based on the test card's CVM list, test card application, amount, and currency.

This is the CVM list for the test card:

Amount threshold

- See the table below. To trigger a particular CVM with a dynamic currency conversion (DCC) transaction, make sure the amount is above the threshold after the conversion.

CVM 1 and CVM 2:

- CVM code: if this CVM is unsuccessful, try the next CVM.

- CVM type: depends on the test card application. See table below.

- CVM condition: the CVM type applies if the transaction is in the currency of the test card application and the amount is above the threshold.

CVM 3

- CVM code: if this CVM is unsuccessful, fail the cardholder verification.

- CVM type: depends on the test card application. See table below.

- CVM condition: the CVM type always applies.

The next table shows the CVM types for each application. Note that to trigger CVM 1 and 2 the amount must be above the threshold and in the currency of the application.

| Application | Interface | CVM 1 amount >200.00 |

CVM 2 amount >100.00 |

CVM 3 | Contactless/NFC above CVM limit |

Offline within set limits |

|---|---|---|---|---|---|---|

| mc en gbr gbp | EMV chip + Contactless | Online PIN | Offline enciphered PIN | Signature | Online PIN | Decline after 3 tries |

| mc en usa usd | EMV chip | Signature | Online PIN | No CVM | Decline after 3 tries | |

| ms nl nld eur | EMV chip | Online PIN | Offline enciphered PIN | Offline plaintext PIN | Always decline | |

| mc en aus aud | EMV chip | Online PIN | Plaintext PIN | Signature | Decline after 3 tries | |

| mc cn chn cny | EMV chip | Offline enciphered PIN + Signature | Signature | Offline plaintext PIN | Decline after 3 tries | |

| mc pt bra brl | EMV chip | Online PIN | Offline enciphered PIN | Signature | Decline after 3 tries | |

| MSR | MSR | Signature | Decline after 3 tries |

For online PIN, with the card inserted in the card reader, the test system will accept any PIN code you enter.

For offline PIN, with the card inserted in the card reader, the transaction will be declined if you enter an invalid PIN.

If you are testing a contactless transaction, you will be asked to enter a PIN when the transaction amount is above the contactless reader limit specific for the country/region the terminal is located in.

You can find the latest limits in your Customer Area under In-person payments > Terminal settings > Payment features > Limits > Contactless CVM limit.

Testing offline transactions

To test offline EMV transactions:

- Contact our Support Team and ask them to configure the chip floor limit, offline swipe limit, and offline refund limit to the values you want.

- Force an internet connection failure, for example by unplugging the Ethernet cable.

- Do your test transactions. The test card enforces the offline limits configured in your test Customer Area.

Each application on the test card has its own counter for offline EMV transactions. Offline EMV transactions within the configured offline limits are accepted until the counter is exceeded. The first three offline transactions for the test card application are accepted and the fourth is declined. To reset the offline counter for a test card application, you need to do an online EMV chip transaction (inserting the card) with that application. This also applies to the application mc en gbr gbp. This application shares the offline counter with the contactless application, but contactless transactions cannot reset the counter.

Simulating declined payments

In general, test payments are approved. To simulate declined payments, you need to change the last three digits of the RequestedAmount that you specify in the payment request.

For example, to test how your integration responds when the issuer suspects fraud, specify an amount with 151 as the last three digits, such as 101.51 or 21.51.

In a classic library integration you can run the same simulations, but the response returns a generic DECLINED_ONLINE posResultCode in most cases. To verify the details of a simulation, you can:

- Check the transaction in the Customer Area.

- Check the raw response in the notification for the transaction.

The following table shows:

- The last three digits of the amount to specify for simulating a specific response.

- The

Result,ErrorCondition,AdditionalResponse.refusalReason, andAdditionalResponse.messagefrom the Terminal API response.

The refusalReason and message are included for additional insight, and should not be coded against. For instructions on how to handle declines, see Declined payments.

| Amount ending in | Result |

ErrorCondition |

refusalReason |

message |

|---|---|---|---|---|

| 121 | Failure | Refusal | 214 Declined online | CANCELLED |

| 122 | Failure | Refusal | 124 acquirer fraud | ACQUIRER_FRAUD |

| 123 | Failure | Refusal | 214 Declined online | DECLINED |

| 124 | Failure | Refusal | 210 Not enough balance | NOT_ENOUGH_BALANCE |

| 125 | Failure | Refusal | 199 Card blocked | BLOCK_CARD |

| 126 | Failure | Refusal | 228 Card expired | CARD_EXPIRED |

| 127 | Failure | Refusal | 214 Declined online | INVALID_AMOUNT |

| 128 | Failure | InvalidCard | 214 Declined online | INVALID_CARD |

| 129 | Failure | Refusal | 214 Declined online | NOT_SUPPORTED |

| 130 | Failure | Refusal | 214 Declined online | ERROR |

| 131 | Failure | Refusal | 214 Declined online | DECLINED |

| 132 | Failure | Refusal | 214 Declined online | DECLINED |

| 133 | Failure | Refusal | 214 Declined online | REFERRAL |

| 134 | Failure | WrongPIN | 129 Invalid online PIN | INVALID_PIN Remark: the terminal shows "Incorrect PIN" and then "Enter PIN". Cancel the payment on the terminal to get the failure response. |

| 135 | Failure | Refusal | 128 Online PIN tries exceeded | PIN_TRIES_EXCEEDED |

| 136 | Failure | Refusal | 207 Issuer unavailable | ISSUER UNAVAILABLE |

| 137 | Failure | Refusal | 211 Withdrawal amount exceeded | WITHDRAWAL_AMOUNT_EXCEEDED |

| 138 | Failure | Refusal | 212 Withdrawal count exceeded | WITHDRAWAL_COUNT_EXCEEDED |

| 139 | Failure | Refusal | 210 Not enough balance | NOT_ENOUGH_BALANCE Remark: combined with the tender option AllowPartialAuthorisation, an amount ending in 139 will not fail. Instead, the result is a partial payment. |

| 142 or 143 | Remark: Tap the card. The terminal shows Contactless limit exceeded, insert card. | |||

| 144 | Failure | Refusal | 214 Declined online | NOT_SUBMITTED |

| 145 | Failure | Refusal | 214 Declined online | DECLINED The raw response is FRAUD_CANCELLED |

| 146 | Failure | Refusal | 214 Declined online | TRANSACTION_NOT_PERMITTED |

| 147 | Failure | Refusal | 214 Declined online | CVC_DECLINED |

| 148 | Failure | Refusal | 214 Declined online | RESTRICTED_CARD |

| 149 | Failure | Refusal | 214 Declined online | DECLINED The raw response is REVOCATION_OF_AUTH |

| 150 | Failure | Refusal | 214 Declined online | DECLINED The raw response is DECLINED NON GENERIC |

| 151 | Failure | Refusal | 214 Declined online | ISSUER_SUSPECTED_FRAUD |

| 152 | Failure | Refusal | 214 Declined online | NO_CHECKING_ACCOUNT Note that the Customer Area reports "52: No savings account" |

| 153 | Failure | Refusal | 214 Declined online | NO_SAVINGS_ACCOUNT Note that the Customer Area reports "53: No checking account" |

| 154 | Failure | Cancel | 219 Shopper cancelled ctls fallback | 219 Shopper cancelled ctls fallback Remark: tap the card. The payment falls back to a non-contactless payment. The terminal shows "Present card" again, but this time without the contactless icon. Cancel the payment on the terminal to get the failure response. |

| 155 | MOBILE_PIN_REQUIRED Remark: Tap the card. The terminal shows See mobile for instructions. Note that in the test environment the only option is to cancel the transaction. |

|||

| 156 | Intended for internal testing by Adyen. Do not use this for your own test cases. | |||

| 157 | Failure | Refusal | 212 Withdrawal count exceeded | AUTHENTICATION_REQUIRED |

| 158 | Failure | Refusal | 235 AID banned | BAN_CURRENT_AID Remark: in a live environment, this is the response when the application is in the penalty box, offline processing is not possible, and there are no other applications on the card. |

| 159 | Failure | Refusal | 214 Declined online | ONLINE_PIN_REQUIRED |

| 160 | Failure | Refusal | 214 Declined online | TRY ANOTHER INTERFACE Intended for internal testing by Adyen. Do not use this for your own test cases. |

| 161 | Failure | Refusal | 214 Declined online | CHIP_DOWNGRADE_MODE Intended for internal testing by Adyen. Do not use this for your own test cases. |

| 162 | Failure | Refusal | 214 Declined online | SECURITY_VIOLATION |

| 163 | Failure | WrongPIN | 129 Invalid online PIN | INVALID_PIN |

| 164 | Failure | Refusal | 207 Issuer unavailable | ISSUER_UNAVAILABLE |

| 165 | Failure | Refusal | 214 Declined online | ERROR |

| 166 | Failure | Cancel | 102 Shopper cancelled pin entry | Shopper cancelled pin entry Remark: to get this result, on the PIN entry screen select Cancel, and on the next screen choose to not continue the transaction. The raw response is PIN_REQUIRED. |

Raw responses

In our back end, we receive the payment response from card schemes and issuers. In case of a declined payment, we map the raw response to a combination of ErrorCondition, refusalReason, and message and return this in the Terminal API response.

Raw responses provide additional information, but you do not need to test them because you should not code against them. If you base your failure-handling logic on raw responses, that might break your integration because acquirers and issuers sometimes change their raw responses without notice.

If you still want to receive the raw response, you can:

- Set up standard webhooks with the additional setting Add Raw Acquirer Result enabled.

- For a Terminal API integration, configure receiving raw responses.