In Brazil, shoppers commonly use a combo card that has both a debit and a credit functionality, and most credit cards accept installment payments. Consequently, when paying by card, shoppers are asked to make some choices:

- Do they want to pay by debit or credit?

- If credit, do they want to make a one-off payment of the total amount or do they want to pay in installments?

- If installments, how many installments?

Here we explain how to flag in-store card payments as credit or debit and make credit card installment payments either:

- Automatically: with this flow enabled, the terminal automatically shows screens that let the shopper make their choices, and then processes the payment request according to those choices. This flow works for integrated and standalone payment terminals.

- Through the Terminal API payment request: you use your own UI or some other process to get the shopper's choices, and then pass this information in your payment request.

Requirements

| Requirement | Description |

|---|---|

| Integration type | A Terminal API integration with payment terminals or a standalone solution. |

| Limitations | Note the following:

|

| Setup steps | To use the automatic flow, ask our Support Team to enable that flow. Let them know whether you want this to be configured for a company account, a merchant account, a store, or a terminal. |

Automatic flow

To use the automatic flow, contact our Support Team and let them know whether you want this to be enabled for a company or merchant account, a store, or a terminal. The automatic flow works for integrated and standalone payment terminals.

When enabled, the flow is as follows:

-

You initiate a payment like you usually do.

-

The terminal shows a series of prompts:

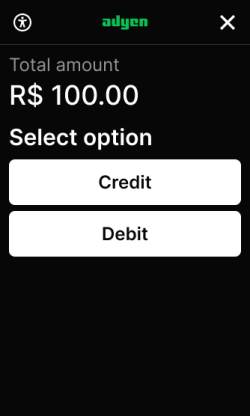

- First, the terminal asks the shopper to choose if they want to pay by debit or credit.

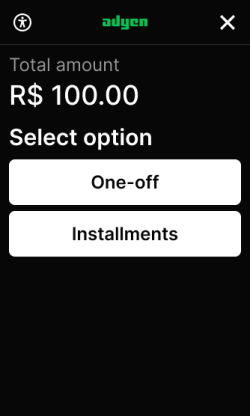

- If the shopper selects Credit, the terminal asks them to select if they want to pay in Installments or as a One-off payment.

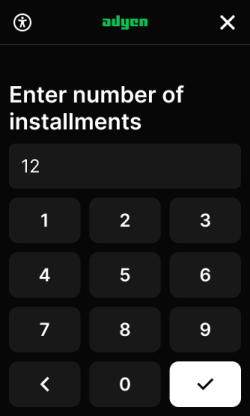

- If the shopper selects Installments, the terminal asks them to Enter the number of installments and select Confirm.

Select card type screen

Select payment type screen

Enter number of installments screen

-

The terminal asks the shopper to present their card.

-

The shopper completes the payment on the terminal. They may need to enter their PIN or signature to verify the payment.

When applicable, the generated receipt includes the number of installments, for example, "Crédito em 12 parcelas" ("Credit in 12 installments"). -

If you are using an integrated terminal, you can find the installment information in the Terminal API response:

PaymentResult.PaymentType: Instalment.PaymentResult.Instalment: an object containing:InstalmentType: EqualInstalmentsSequenceNumber: 1Period: 1PeriodUnit: MonthlyTotalNbOfPayments: the number of installments.

Response.AdditionalResponse: installments= with the number of installments.

Terminal API flow

Depending on your use case, you can also make API requests to flag in-store card payments as credit or debit and make credit card installment payments. This allows you to use your own UI or some other process to collect the shopper's choices.

With a Terminal API integration, the flow at the point of sale is as follows:

- You collect the information about whether the shopper prefers to pay by debit or credit, and if applicable, in how many installments. You can do this in the various ways, for example:

- Your store staff asks the shopper about their preferences.

- You collect the shopper's preferences on a secondary screen, for instance a tablet.

- You use input requests to collect the shopper's preferences on the payment terminal.

- You use logic to pass the collected information to your POS app or your store staff enters this information manually into your POS app.

- Your POS app passes this information to the payment request.

- The shopper presents their card to the terminal and completes the payment.

- When the transaction is approved, you receive a response containing installment and receipt data.

The receipt includes the number of installments, for example, "Crédito em 12 parcelas" ("Credit in 12 installments").

Make a payment with Terminal API

The Terminal API payment request needs to contain a flag to indicate a debit or credit card payment. When paying by credit in installments, the request also needs to contain an object to define the installments.

-

Make sure that your POS app collects the following information and passes it to the Terminal API payment request:

- Whether the shopper is going to pay by debit or credit.

- If credit: whether the shopper wants to pay in installments.

- If credit installments: how many installments.

-

Make a payment request, specifying:

-

The standard

SaleToPOIRequest.MessageHeaderobject, withMessageClassset to Service andMessageCategoryset to Payment.Parameter Required Description ProtocolVersion

3.0 MessageClass

Service MessageCategory

Payment MessageType

Request ServiceID

Your unique ID for this request, consisting of 1-10 alphanumeric characters. Must be unique within the last 48 hours for the terminal ( POIID) being used.SaleID

Your unique ID for the POS system component to send this request from. POIID

The unique ID of the terminal to send this request to. Format: [device model]-[serial number]. -

The PaymentRequest object with:

Parameter Required Description SaleData.SaleTransactionID

An object with: TransactionID: your reference to identify a payment. We recommend using a unique value per payment. In your Customer Area and Adyen reports, this shows as the merchant reference for the transaction.TimeStamp: date and time of the request in UTC format.

PaymentTransaction.AmountsReq

An object with: Currency: the transaction currency.RequestedAmount: The final transaction amount.

-

-

Add a flag to specify if the shopper wants to pay by debit or credit:

TransactionConditions.DebitPreferredFlag:- true: makes a debit card payment.

- false: makes a credit card payment.

For a debit card payment or a one-off credit card payment, no further parameters are required.

-

If the shopper is paying by credit card in installments, define the installments by adding:

PaymentData: the installment details. This contains:PaymentType: InstalmentInstalment.InstalmentType: EqualInstalmentsInstalment.SequenceNumber: 1Instalment.Period: 1Instalment.PeriodUnit: MonthlyInstalment.TotalNbOfPayments: the number of installments. The minimum is 2, the maximum 36.

Here are some sample requests:

-

If the payment is successful, the terminal shows the payment is approved, and you receive a PaymentResponse that contains:

-

PaymentReceipt: Dynamically generated receipt data that you can use for printing (or emailing) receipts. Both the merchant receipt and the shopper receipt have additional required keys:productType: Indicates if the shopper paid by debit, credit, or credit in a specified number of installments.-

cnpj: identification number issued for the Brazilian National Registry of Legal Entities.

-

If the shopper paid in installments, the response also includes:

PaymentResult.PaymentType: Instalment.PaymentResult.Instalment: An object containing the same installment details that you defined in thePaymentDataof your payment request.-

Response.AdditionalResponse: installments= with the number of installments.

Here is a sample response for a credit card payment with 12 installments:

-

Reconciling installments

If a shopper pays in installments, the first installment is immediately charged to the shopper's credit card, and all future installments will be charged automatically.

You receive the funds for each installment as it is settled. There is a settlement delay of 30 days. If you need the funds sooner, we also offer advancements. There is an additional fee for this service. Contact your Adyen Account Manager for details.

If you use standalone terminals, you need to manually reconcile your point-of-sale transactions against your sales and returns.

For more information on how installments are settled and reconciled, see Reconcile installment payments.